Strategic execution must accompany strategic planning, otherwise the strategic objectives and goals simply becomes words on a page. In my experience, I have seen companies post their strategies on a wall without any method or approach for ensuring that those strategies are accomplished. About 30 years ago, a survey was conducted highlighting that about 90% of strategies were never fulfilled. Unfortunately, there is little indication that this figure has dropped much. Hence, there is a strong need for strategic execution.

While ‘strategic execution’ may come across as a mere buzz word, some explanation will help articulate what strategic execution is about. Execution-MIH, specialists in the field of execution management, would describe strategic execution as the ability to translate strategy into reality. It is one thing to develop a strategy, it is another thing to make it actionable and achievable. “[Execution management] is not just accomplishing a task or a goal, but also to achieve the underlying business objectives…Good execution management will focus on the WHAT as well as the HOW of an achievement.“ Too often, executives focus on the what, but pay too little attention on the how.

Gary Cokins, a strategist at software company SAS, has pointed out that decision makers need discipline to utilize a comprehensive performance management approach described as “a closed-loop, integrated system that spans the complete management planning and control cycle.” Project portfolio management (PPM) is the comprehensive performance management approach that Gary Cokins is referring to and is the bridge between strategic execution and operational excellence. Having articulated the strategic goals and objectives for an organization, projects and programs are launched that directly accomplish the goals and objectives. These projects and programs become the HOW referred to above. Although some strategic decisions are related to policy changes, most strategic goals require work to be done for its fulfillment. Projects and programs therefore help get this work done, and thus become the vehicles for strategic execution.

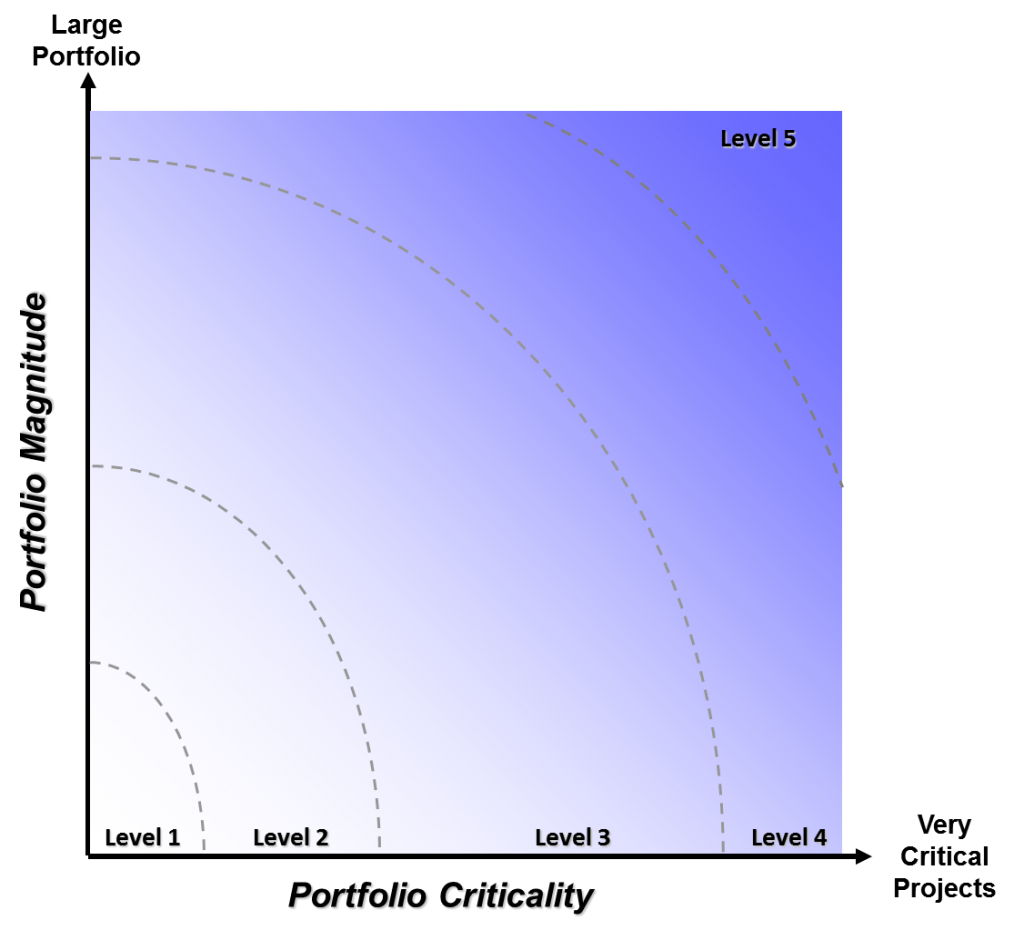

In summary, strategic execution is how companies accomplish their strategies. It begins with strategy development and continues with strategic planning. This information feeds a portfolio management system which identifies the best projects and programs (including priority and sequence) and optimizes against resource capacity. The completion of these projects and programs signals the transition of the project work into operations. Once all of the necessary projects and programs related to a particular strategy are complete, the organization should realize the benefits of its strategy.