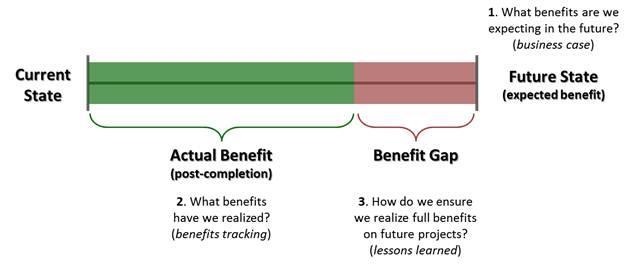

The purpose of validating benefits is to ensure that real value has been delivered from projects post-implementation as well as increase value from future projects when shortfalls have been identified in present projects. Although the business case promises to deliver a certain amount of value (in most cases), few companies take the time to ensure that real value gets delivered post-implementation. It requires real organizational discipline and rigor to do it well. The following three questions capture the full scope of benefits realization:

1. What benefits are we expecting in the future?

2. What benefits have we realized?

3. How do we ensure we realize full benefits on future projects?

Question one starts with the business case, specifically with cost-benefit analysis. There are no benefits to measure in the future if they don’t get captured before the project is fully initiated. Business case development is an important capability in portfolio management. Reasonably mature organizations will develop the capabilities of measuring anticipated benefits, often with the help of a senior business analyst. Unfortunately, some organizations are jaded when it comes to cost-benefit analysis and may not do it because of bad experiences in the past and the lack of accountability in the process. The purpose of tracking benefits is to help the organization ensure it gets the value it is expecting and to take action when the value is not realized.

Question two focuses on measuring the benefits after a project has closed down. The person accountable for delivering the project benefits (e.g. project sponsor) should use the same metrics documented in the business case to help track and validate the project benefits. In a mature organization, the effort to track benefits will resemble the effort at the start of the project to document expected benefits. The problem many companies face is that a gap often exists between the stated benefits and the actual benefits. This leads to question three.

Apparently, tracking benefits should be the end of the validation process. However, question three addresses the problem of gaps between anticipated and actual benefits. The scope of validating benefits is complete once gaps are addressed and resolved. This requires that the company take the time to analyze why the benefit gaps exist and to capture lessons learned that will be used by future project teams to do a better job of realizing benefits. This step completes the portfolio lifecycle of selecting the right projects, optimizing portfolio value, protecting portfolio value, and delivering portfolio value.

Virtually all of the benefit to a company comes after a project has been delivered. In order to increase the benefits realized from its projects, the organization should track the benefits that are actually received. According to Gaylord Wahl of Point B, such post-implementation evaluations can help improve business case development, which, in turn, increases the odds that the project portfolio will contain more winning projects going forward.